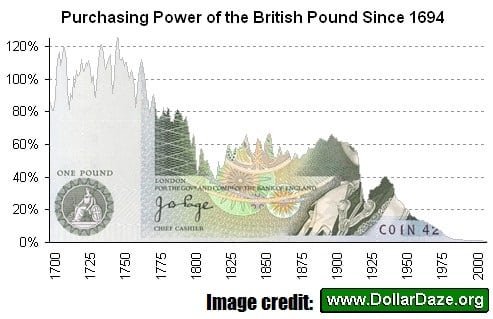

When you have savings in the bank you are losing value. Of course, you keep the same amount of currency that you deposited and you even earn a little interest (very little these days) but you are still losing value. Why? Because of inflation. Even with the interest given by your bank, you will still be losing value over time as your cash sits in savings.

You can check out Measuring Worth for a cool (scary) calculator that shows you how currency loses value over time.

The good news is there are ways to get inflation beating interest rates. Each method has it’s pros and cons and we will look at 3 of the best options.

#1. Cryptocurrency Lending

Don’t worry, you don’t have to buy any Bitcoin for this one. There are companies that lend out cash to businesses secured by their cryptocurrency holdings. They require fiat currency (pounds, dollars, etc) to lend out to these businesses. If you lend these businesses your cash you can earn 8% on your money. A company called Nexo will accept your Pounds and Euros, while Blockfi will accept your dollars.

If you are interested in cryptocurrency at all then the good thing about Blockfi is they offer the option to have your interest paid in Bitcoin or Ether! This is a great way to get your feet wet in crypto without having to buy any directly.

The potential risks with this method is the fact that unlike a bank your money is not backed by deposit protection schemes. Do your research into any company you invest with and understand their risk management strategies to keep your money safe.

#2. Peer-To-Peer Lending

Peer-to-peer lending is where you loan money to businesses seeking finance. There are a number of platforms in the UK that you can use to lend out your cash. It is possible to earn around 8-10% on your money with this option. Most platforms require you to select which loans to fund and in what amounts (though there are automated options as well).

The potential risk with this option is that the businesses default on their loans. You can mitigate this by diversifying the businesses you lend to and ensuring you only lend a small portion of your savings to each. You should also remember that it is not usually possible to withdraw your capital during the term of the loan so make sure to only invest your long-term savings.

#3. Lending To Property Investors

If you have savings of £100,000 or more you could consider lending to a property investor. Often, investors need cash to purchase properties that they will refurbish and refinance. You can lend at 8-12% (or sometimes more) and have your loan secured against the property. The investor will normally refinance the property in 6-18 months and return your interest and capital. If they can’t refinance for any reason they will keep paying you the agreed interest rate until they can pay back your capital.

The potential risk with this method is that the investor defaults on the loan. You can mitigate the risk by securing the loan against the property and ensuring the loan-to-value (the amount you lend compared to the market value of the property) isn’t too high.

Remember...

Always do your research before parting with your cash. Be careful and understand the risks associated with any investment.