As we exited lockdown, many people were surprised to see both property prices and demand up. While there are a number of factors which play into this, quantitative easing is potentially a major player. In this article, we will look at the Bank of England’s role in the current property uptrend.

In a previous post called Explaining Fiat Currency With A £150,000 Pokemon Card! we looked at how the creation of fiat currency (pounds, dollars, euros, etc) causes the purchasing power of that currency to go down. If you are unfamiliar with this topic, I would recommend reading that post before this one.

What Is Quantitative Easing?

Quantitative easing (QE) is the creation of additional money by the central bank of a nation to buy bonds or other financial assets as a means of stimulating the economy. When new currency is created, it reduces the value of existing currency. This new currency therefore pushes prices up.

In this short video, the Bank of England explains that they don’t even print up this money, instead simply adding a few extra zeros to their online accounts:

Following the recession of 2008 there has been a number of rounds of quantitative easing.

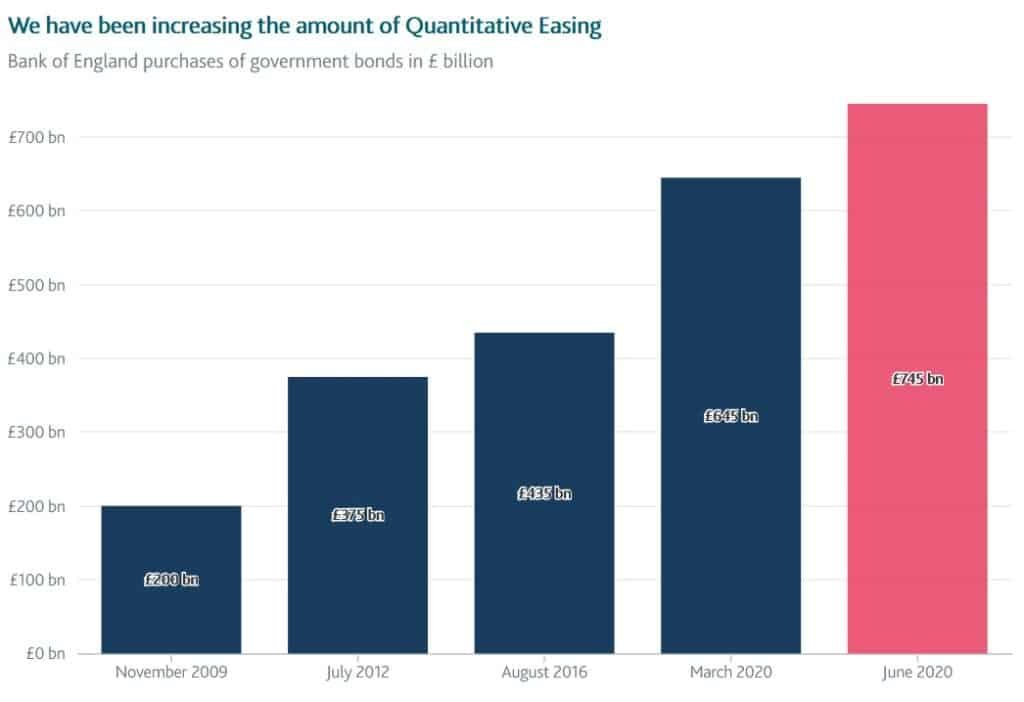

In June 2020, the Bank of England undertook a £100bn round of QE. This is a chart that shows their cumulative government bond purchase via QE:

When this new currency is created the market does not immediately react and adjust prices to compensate for the new currency in the system. This means the large funds, banks and companies that receive this money first in the form of bond purchases are at an advantage. They can, at first, purchase assets at prices that, by and large, reflect the value of currency before the round of QE.

As the additional demand created by the new currency is noticed by the market the prices of the assets they buy begin to rise. Eventually this will cause price rises across the economy in the form of inflation.

How QE Pumps UK Property Prices

The new currency created by quantitative easing increases the UK property prices in two major ways. Firstly, the new currency, over time, reduces the spending power of each individual pound. This means even if a property remains static in value, it’s price in currency will go up. Furthermore, because this new currency goes to funds and banks first that invest that money, this additional currency will impact the price of assets (including property), before it impacts the cost of consumer goods.

The second impact of QE on property prices is the realisation among high net worth individuals and investment funds that the value of their currency position will continue to go down. This forces them to move their money into assets with a limited supply. At the time of writing, Bitcoin, gold, silver and property are all up and I think this is no coincidence.

As Governments continue to print currency driving down its value, more and more value will be driven into the property market. If and when these continual rounds of QE result in massive inflation, even if property values go down, prices will go up!

As a side note: This blog has been listed on Feedspot’s Top UK Property Blogs & Top 10 UK Cryptocurrency Blogs lists. Thank you to them for listing us!