The media has been full of alarmist headlines “UK plunges into deepest recession on record” screams The Independent, “UK plunges into deepest ever recession as GDP tumbles 20%” shouts The Evening Standard, but what is the reality of the situation?

A recession is when there is two consecutive quarters where the GDP of the nation drops i.e. there is a drop in the total expenditure of the economy. Quarter 1, January to March, saw a drop of 2.2% and Quarter 2, April to June, saw a massive 20.4% drop according to the Office for National Statistics.

No Surprise!

Lockdown started on 23 March 2020, and worries about coronavirus started even before this, so of course there was a drop in the total spending in the economy! With cafes, bars and other business closed this should come as a surprise to no one. So the announcement that we are in a recession is a formality rather than actual news.

The extent of the drop may be argued to have been a surprise. However, the Governor of the Bank of England said in July that the UK could have a “23 to 25 per cent” contraction in the second quarter. The UK has a large hospitality sector so a lockdown was inevitably going to have this type of effect.

Short Term Recovery

We are already seeing signs of a recovery with the Office for National Statistics stating there has been a rise in GDP of 8.7% during June. With the lockdown over, this is likely to continue and we should see this trend continuing in the next quarter.

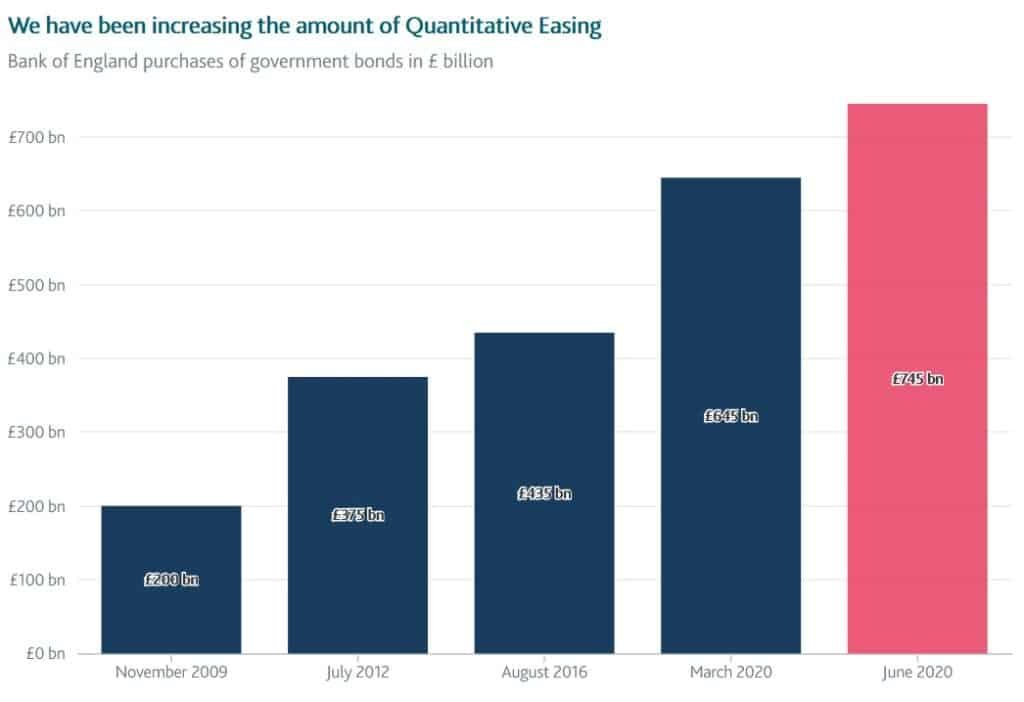

The Bank of England printed £100 billion in new currency in June in its latest round of quantitative easing.

What is quantitative easing?, BoE

Continual currency printing means that the value of existing currency will go down overtime. However, the circulation of this currency means that the total spend in the economy will go up, leading to an increase in GDP.

This currency printing, combined with the various measures used by the Government such as Bounce Back loans, self-employment grants and Eat Out To Help Out discounts, are likely to see the economy appear to recover significantly.

In the short term, it is possible that we will soon come out of this recession and see economic growth again.

Long Term Problems

Longer-term is a different story. As government programmes stop and the build up of currency in the economy either forces the Bank of England to contract the currency supply by rising interest rates or do nothing and see higher levels of inflation, the real problems will start.

If the Bank of England decides to continue with further rounds of quantitative easing, things could get even worse. The continued printing of currency will cause prices to rise. Holding your savings in currency will not be a good idea at this point as its purchasing power will be decreasing fast. Assets with a limited supply will do well in my opinion such as gold/silver, Bitcoin and property.

In my view, this recession is more of a warning than a reality. It is giving us time to prepare. The ONS announcement told us what we already knew and the media headlines were typically alarmist.